Why is HYPE not a good investment target at the moment?

TechFlow Selected TechFlow Selected

Why is HYPE not a good investment target at the moment?

Buybacks have consistently been the primary mechanism supporting HYPE's price, yet upcoming token unlocks are equally significant and cannot be overlooked.

Written by: Dave

Abstract

HYPE has implemented a robust buyback mechanism (approximately $1.3 billion to date, accounting for about 46% of the total token buybacks planned for 2025) and is supported by solid revenue. I believe almost all researchers are very optimistic about this token, but today I'm going to present a contrarian view: several structural and macro factors make HYPE a less "sweet" trade.

1. Buyback VS Unlock

The buyback has been the primary mechanism supporting the HYPE price, a point many KOLs have mentioned. However, future token unlocks cannot be ignored.

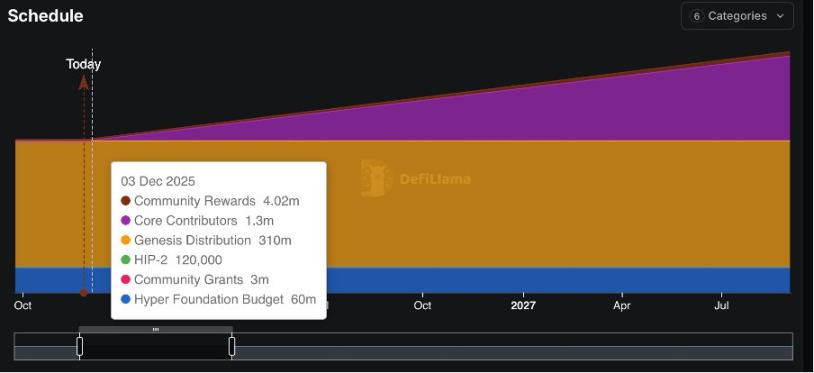

Starting from 2025-11-29, 373 million HYPE (approximately 37% of the total supply) will be unlocked, at a rate of about 215,000 HYPE per day over a 24-month period. Calculated at the current price, this will create potential selling pressure of roughly $200 million per month.

In comparison, the total buyback amount for 2025 is $644.64 million, averaging about $65.5 million per month, funded by 97% of transaction fees. The daily buyback can only cover 25-30% of the daily unlock volume. Even if revenue continues to grow strongly, the buyback capacity will struggle to absorb an unlock of this scale, inevitably leading to price compression.

2. Market Cycle Risk & Valuation Fragility

Currently, almost all valuations of HYPE (including the widely cited P/E, which is actually calculated on a trailing-twelve-months basis) are based on strong data from the past few months—a bull market. But as a "retail investor" who experienced the 2022 bear market, I believe macro cycle factors are a crucial variable that must be considered. At least in the foreseeable future, the probability of a bear market is not lower than that of a bull market, challenging core assumptions and metrics.

2.1 Current Snapshot

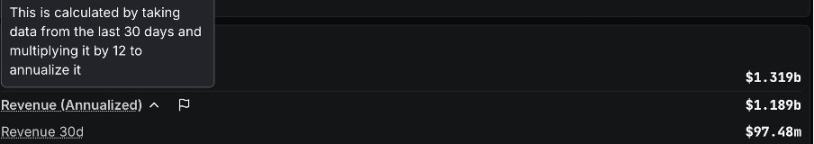

The current revenue metrics are indeed very strong:

-

· Annualized Revenue: $1.2 billion

-

· Fully Diluted Valuation (FDV): $31.6 billion

-

· Circulating Supply: $20 billion (Source: Defillama)

-

· TTM P/E is approximately 16.67

· Monthly compound revenue growth from 2024-12 to 2025-08 was +11.8%

These figures seem attractive compared to most US-listed companies, but that's precisely the issue—in an upcoming bear market, HYPE could potentially face a more severe Davis Double Whammy situation than other projects.

2.2 Bear Market Scenario and the Davis Double Whammy

Looking back, the correlation coefficient between perpetual contract trading volume and BTC price is >0.8 (across cycles).

-

· 2022 Bear Market: Perpetual contract trading volume fell by 70% compared to the 2021 peak.

-

· Revenue Dependence: 91% comes from transaction fees, making it highly vulnerable to trading volume shocks.

-

· Withdrawal Delays: HLP vault requires a 4-day lockup, and centralized exchange withdrawals take 24-48 hours.

This is a classic Davis Double Whammy setup: crypto asset price decline → trading volume & fees drop, while valuation multiples contract → creating a vicious cycle.

Most valuations of $HYPE are based on its performance during the past year's bull market. However, in the Web3 space, revenue is highly cyclical. We should adjust our fundamental assumptions accordingly.

Unlike US stocks, which can be seen as smooth growth since 2008 when viewed over a long period, the cryptocurrency market still exhibits cyclical characteristics of sharp rises and falls. While macro market factors are indeed difficult to quantify, the ability to grasp this cyclicality is precisely what distinguishes excellent traders from top-tier traders within the crypto space.

2.3 Crypto-Native Metrics

We know that even in traditional finance, the Price-to-Earnings (P/E) ratio is not the only metric; there are others like EV/EBITDA, P/FCF, ROIC. For HYPE, some other important metrics also need to be considered, including:

-

TVL: $4.3 billion, but showing a clear downward trend from the September 2025 peak of $6.1 billion.

-

P/TVL: 2.0 (Solana 1.5).

Market Share: Market share has declined from a peak of 80% to 70%, credit to the dark horse Aster. Of course, there are also a bunch like lighter edgex.

3. Is Dave an Idiot FUDing HYPE? Not Absolutely

Although I currently do not agree with investing in HYPE, my bearish stance only applies from a medium-term perspective. If we focus on a long-term investment horizon of 2-5 years, HYPE is absolutely worth investing in. This requires no further explanation.

A complete investment decision depends on various factors, including portfolio allocation, tolerance for drawdowns, and investment objectives, etc.

All projects face pressure in a bear market. What are the alternatives?

Prediction markets might currently offer higher cost-effectiveness. @a16z research indicates the correlation between prediction markets and the broader market is only 0.2-0.4, compared to $HYPE's >0.8.

Furthermore, 2026 will see numerous high-profile events, such as the World Cup (the last for many veterans like Messi and Ronaldo), US midterm elections, the Winter Olympics, the League of Legends World Championship, etc., along with quite a few game, movie, and anime releases like GTA6. It can be foreseen that it will be a big year for betting. A significant amount of off-market capital might flow into this sector, potentially even impacting the Nasdaq. If one follows the medium-term trend, prediction market-type projects are worth paying attention to.

Conclusion:

From a medium-term perspective, the risks posed by large-scale unlocks, revenue cyclicality, and shifts in the macro market environment outweigh the returns offered by the current valuation. This article does not constitute any investment advice. All investments carry risks. NFA, DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News