Galaxy Digital (GLXY) Research: A Hybrid of Web3 Institutional Service Providers and AI Data Centers

TechFlow Selected TechFlow Selected

Galaxy Digital (GLXY) Research: A Hybrid of Web3 Institutional Service Providers and AI Data Centers

Galaxy Digital's market valuation is significantly lower than the sum of its segment values.

Written by: Lawrence Lee

1. Research Summary

Galaxy Digital (GLXY) is a hybrid platform spanning crypto finance and AI computing power. Its business structure encompasses three core modules: ① Global Markets (trading, market-making, and crypto investment banking); ② Asset Management & Infrastructure Solutions (fund management, staking, custody, and proprietary investments); ③ AI Data Centers & Computing Power Infrastructure (Helios campus).

Over the past three years, Galaxy has achieved a leap from the lows of the crypto winter to synergistic growth across multiple businesses. In Q3 2025, driven by the Digital Asset Treasury Company boom and the sale of 80,000 BTC, it generated over $730 million in adjusted gross profit, reaching a new high. Asset Management and Staking business AUM reached $9 billion, staking scale surpassed $6.6 billion, with annual management fees exceeding $40 million. Meanwhile, the Helios mining facility has fully transitioned into an AI computing power campus, signing a 15-year long-term contract with CoreWeave. The three-phase lease locks in the entire 800MW power capacity, with projected annual revenue exceeding $1 billion upon full delivery.

GLXY's financial performance is highly volatile and significantly impacted by the crypto market: it incurred a loss of nearly $1 billion in 2022, turned profitable in 2023, and achieved a net profit of $365 million in 2024. Although it declined in the first half of 2025, Q3 single-quarter profit set a new record of $505 million despite overall market volatility, with adjusted EBITDA turning significantly positive, indicating enhanced resilience in core businesses.

Regarding valuation, we employ an SOTP (Sum-of-the-Parts) framework: the segment valuation for Galaxy's digital asset financial services business is $7.7 billion; the segment valuation for the AI computing power infrastructure business is $8.1 billion, totaling $15.8 billion. Adding net assets yields a total equity value of approximately $19.4 billion. Galaxy's current market capitalization is $10.1 billion, representing a 48% discount to our SOTP calculation. The reason may be that investors adopt a conservative valuation strategy for companies simultaneously facing industry cyclical fluctuations (according to crypto cycle theory, the current peak) and business transformation challenges (computing power business only begins delivery in 2026).

PS: This article represents the author's interim thoughts as of publication, which may change in the future. The views are highly subjective and may contain factual, data, or logical reasoning errors. All views herein are not investment advice. Criticism and further discussion from peers and readers are welcome.

2. Business & Product Lines

Galaxy Digital was founded in 2018 by former Wall Street star investor Michael Novogratz. Novogratz was previously a partner and macro fund manager at the renowned hedge fund Fortress. Currently, Galaxy Digital's business landscape has formed "three core segments": ① Global Markets (including trading, derivatives market-making, investment banking, and lending services, etc.); ② Asset Management & Infrastructure Solutions (including fund management, staking services, proprietary investments, etc.); ③ Data Centers & Computing Power Business (including previous Bitcoin mining and the ongoing AI/HPC high-performance computing infrastructure). Below, we provide a detailed breakdown of the business models, latest developments, and revenue contributions of each major product line.

2.1 Global Markets

Business Content & Definition

The Global Markets business encompasses Galaxy Digital's digital asset trading and related financial services provided to institutions, serving as its core revenue source. This module includes two main segments: Franchise Trading and Investment Banking. The Franchise Trading team acts as a market maker and liquidity provider in the crypto market, offering over-the-counter (OTC) services for spot and derivatives to more than 1,500 counterparties, supporting trading in 100+ mainstream crypto assets. Simultaneously, Galaxy utilizes regulated entities to conduct digital asset collateralized lending, OTC prime brokerage, and structured yield product businesses, providing leverage, hedging, and instant liquidity solutions for institutional clients like miners and funds. The Investment Banking team provides professional financial advisory services to blockchain and crypto industry companies, including M&A advisory, equity and debt financing arrangements, private placements, etc., helping digital asset companies connect with traditional capital markets. This suite of services enables Galaxy to offer institutional investors comprehensive financial solutions akin to Wall Street investment banking standards, meeting the evolving needs of the crypto finance ecosystem.

Key Development History

- 2018–2019: Galaxy Digital was founded in 2018 with the goal of "bringing crypto to Wall Street and Wall Street to crypto." Early on, it began building a comprehensive platform covering trading, asset management, and investment, quickly accumulating an institutional client base.

- 2020: Galaxy achieved a leap in trading business expansion through acquisitions: In November 2020, it acquired digital asset lending and structured products company DrawBridge Lending and professional market maker Blue Fire Capital to enhance its capabilities in OTC lending, futures derivatives, and bilateral market-making. This rapidly extended Galaxy's trading reach into advanced products like leveraged loans, OTC options, and structured notes, boosting its OTC annual trading volume to over $4 billion and active counterparties to nearly 200.

- 2021: The company appointed seasoned professionals like former Goldman Sachs executive Damien Vanderwilt to establish an investment banking department focused on the crypto industry, providing M&A and financing advisory services. That same year, Galaxy continued enriching its product line by acquiring Vision Hill Group (a digital asset investment advisor and crypto fund index provider), strengthening fund products and data analytics capabilities. On the trading side, the Galaxy Digital Trading team developed the GalaxyOne integrated trading platform (combining trading, lending, and custody) and completed the key technical framework within the year, laying the foundation for a subsequent unified institutional services portal.

- 2022: Despite the crypto market entering a winter, Galaxy's Global Markets business continued steady expansion. The Franchise Trading department increased counterparty count to 930+ in Q4, providing continuous market-making and liquidity support for over 100 digital assets. On the investment banking front, the team seized industry consolidation opportunities, participating in several major transactions: for example, acting as financial advisor for Genesis Volatility's acquisition by Amberdata and assisting CoreWeave in securing strategic investment from Magnetar Capital. Notably, when Galaxy itself acquired the Helios mining facility (detailed later in the Data Centers section) at the end of 2022, the investment banking department also provided transaction advisory support, demonstrating internal synergy.

- 2023: As the market gradually recovered, Galaxy's Global Markets business rebounded strongly. That year, Galaxy continued expanding its business coverage in regions like Asia and the Middle East, establishing teams in Hong Kong, Singapore, etc., to serve local institutional clients (e.g., family offices, funds). The investment banking department remained active in the first half of 2023, participating in multiple industry M&A and financing deals, such as: acting as advisor (buy-side) for the acquisition of crypto custody company GK8 by Galaxy and some mining company restructuring projects. Despite ongoing volatility in the crypto industry that year, Galaxy's Global Markets segment showed a more stable revenue curve compared to traditional crypto exchanges, due to its more diversified business model (including interest income, market-making spreads, advisory fees, etc.).

- 2024: This year saw a clear recovery in Galaxy's digital asset market, with the Global Markets business achieving record performance. Full-year 2024 counterparty trading and advisory revenue reached $215 million, exceeding the sum of the previous two years. Q4 alone generated $68.1 million in revenue (up 26% QoQ from Q3). Growth primarily stemmed from active derivatives trading and strong institutional lending demand – Galaxy's OTC derivatives and credit business surged significantly that quarter, counterparty trading volume increased 56% QoQ, and the average loan book size expanded to a record high of $861 million. By the end of 2024, Galaxy's total trading counterparties reached 1,328, a significant increase from the previous year. In investment banking, Galaxy completed 9 advisory transactions in 2024, with 3 successfully closed in Q4 alone, including acting as exclusive financial advisor for Ethereum staking service provider Attestant's sale to Bitwise, and assisting Thunder Bridge Capital's merger and listing with Coincheck (a SPAC transaction). These transactions brought substantial fee income for Galaxy, solidifying its reputation in the crypto investment banking market.

- 2025: Entering 2025, with the digital asset market rebounding strongly driven by ETF and other positive expectations, Galaxy's Global Markets business reached new heights. In Q3 2025, the Global Markets segment created a single-quarter adjusted gross profit of $295 million, soaring 432% from the previous quarter to a record high. The company's total trading volume grew 140% QoQ, reaching the highest level ever, far exceeding average market growth. One standout business was Galaxy being entrusted by a large institution to sell 80,000 Bitcoin (nominal value ~$9 billion), with this single transaction significantly contributing to quarterly spot trading volume. Both major ETH treasury companies, BMNR and SBET, also conducted their ETH acquisitions through Galaxy. Simultaneously, Galaxy's institutional lending business expanded rapidly, with Q3 average loan balance reaching $1.78 billion, up 60% from Q2, indicating increasing institutional demand for crypto credit financing through Galaxy. In investment banking, Galaxy capitalized on the market financing window, completing a $1.65 billion PIPE private placement for Forward Industries (acting as joint placement agent and financial advisor) and serving as exclusive financial advisor for Coin Metrics' sale to Talos in Q3. These heavyweight transaction cases further established Galaxy's leading position in digital asset investment banking. Looking ahead to full-year 2025, amid the crypto treasury company boom, the market expects Galaxy's Global Markets business to achieve revenue and profit levels far exceeding previous years.

Financial Reports & Public Report Summary (2023–2025)

Revenue & Profit: In 2023, as the market was at the tail end of a bear market, Galaxy overall still recorded a loss, but the Global Markets segment showed improvement in the second half. Entering 2024, Global Markets became the primary driver of company performance: full-year counterparty trading and advisory revenue was $215 million, a significant increase compared to 2022 (only about $100 million in 2022 due to market downturn). The proportion of profits from derivatives and quantitative trading increased, and interest income grew with the expansion of lending scale. In 2024, Global Markets business adjusted EBITDA exceeded $100 million, highlighting operating leverage. Q4 2024 Global Markets revenue of $68.1 million directly drove the company's quarterly net profit to turn profitable. By Q3 2025, Galaxy reported that its digital asset business (including Global Markets and Asset Management) achieved a single-quarter adjusted EBITDA of $250 million, with Global Markets contributing significantly. That quarter, the Global Markets segment's adjusted gross profit reached $295 million. This reflects the strong profit elasticity of Galaxy's trading business under bull market conditions. Notably, the company's overall net profit for the first three quarters of 2025 was still affected by proprietary investment volatility (e.g., losses in Q1 due to digital asset price declines), but the growth trend of core operating businesses was quite robust. Management stated in the Q3 2025 earnings report that with the full launch of the GalaxyOne platform and more institutional client onboarding, the company's trading-related revenue is expected to grow further. Meanwhile, the cost-to-income ratio for the Global Markets business decreased (reflecting improved operational efficiency), bringing substantial operating leverage benefits to the company.

GLXY 25Q3 Global Markets Profit, Loan Size, and Counterparty Data

2.2 Asset Management & Infrastructure Solutions

Business Content & Definition

The Asset Management & Infrastructure Solutions segment integrates Galaxy Digital's businesses in digital asset investment management and blockchain infrastructure technical services, serving as an important complement to the Global Markets segment.

In Asset Management, Galaxy provides diversified crypto asset investment products to institutions and qualified investors through its subsidiary Galaxy Asset Management (GAM). Product forms include: 1) Public market products: such as ETFs/ETPs (exchange-traded products) issued in collaboration with traditional institutions, including single-asset ETFs for Bitcoin, Ethereum, etc., and blockchain industry-themed ETFs; 2) Private fund products: including actively managed hedge funds (Alpha strategies), venture capital funds (investing in blockchain startups, e.g., Galaxy Interactive), crypto index funds, and fund-of-funds, offering investors diverse risk-return exposures. Galaxy also provides customized crypto investment services for institutional clients, such as digital asset index construction, treasury management, and co-investment (SPV) opportunities. As of Q3 2025, Galaxy's assets under management (AUM) approached $9 billion, covering over 15 ETFs and alternative investment strategy products. This scale places it among the world's largest crypto asset managers.

In Infrastructure Solutions, Galaxy leverages its own technology and operational experience to provide institutional clients with foundational technical services and custody solutions for blockchain networks. This mainly includes two modules: Custody and Staking. The GK8 platform acquired by Galaxy in 2023 provides institutional-grade digital asset self-custody technology, allowing clients to securely self-custody crypto assets through cold wallets and MPC (Multi-Party Computation) custody solutions. GK8 technology also supports rich functionalities, including participation in DeFi protocols, tokenized issuance, and NFT custody, enabling Galaxy to offer "one-stop" digital asset infrastructure (e.g., token issuance platforms) to institutional clients. In staking, Galaxy established a dedicated blockchain infrastructure team, providing node hosting and staking-as-a-service to clients. This team operates a global network of validator nodes supporting multiple mainstream PoS blockchains including Ethereum and Solana, helping clients delegate their held crypto assets to participate in network validation to earn staking rewards. Galaxy's staking service features institutional-grade security and flexibility: on one hand, through integration with compliant custodians like Anchorage, BitGo, and Zodia, clients can easily stake assets held in custody; on the other hand, Galaxy offers innovative features like staked asset collateralized financing, allowing clients to use staked tokens as collateral for loans, improving capital efficiency. Additionally, Galaxy engages in proprietary investments, investing in quality blockchain startups and protocols through departments like Galaxy Ventures. By the end of 2022, the company had invested in over 100 related companies (145 investments). These strategic investments bring potential financial returns and expand Galaxy's industry influence and partnership network (e.g., Galaxy made early investments in well-known projects like Block.one, BitGo, Candy Digital). Overall, the Asset Management & Infrastructure Solutions module allows Galaxy to vertically extend the industry chain, serving clients with a "dual-engine drive" from managing assets to managing underlying technology.

Key Development History

- 2019–2020: Galaxy began laying out its asset management business, collaborating with traditional financial institutions to issue crypto investment products. In 2019, Galaxy partnered with Canadian CI Financial to launch the CI Galaxy Bitcoin Fund (a Toronto Stock Exchange-listed closed-end Bitcoin fund), one of North America's first publicly offered Bitcoin investment products. Subsequently, in 2020, they jointly launched the CI Galaxy Bitcoin ETF, becoming one of the world's lowest-fee Bitcoin ETFs at the time. Through these collaborations, Galaxy established its pioneer status in the public crypto product space.

- 2021: In May, Galaxy acquired Vision Hill Group (a New York-based digital asset investment advisor and asset management company), integrating its team and products (including crypto hedge fund indices, data platform VisionTrack, crypto fund-of-funds, etc.). Post-acquisition, the Galaxy Fund Management platform could provide institutions with richer data-driven investment decision support and a more comprehensive fund product line. That same year, the Galaxy Asset Management department continued expanding active management products, such as launching the Galaxy Liquid Alpha fund, and ended the year with approximately $2.7 billion in AUM (significant growth from $407 million at the beginning of the year).

- 2022: In Q4, Galaxy announced a strategic partnership with Itaú Asset Management, one of Brazil's largest private banks, to jointly develop a series of digital asset ETF products for the Brazilian market. The two launched their first collaborative product, "IT Now Bloomberg Galaxy Bitcoin ETF," by the end of 2022, enabling Brazilian investors to gain physically-backed Bitcoin exposure through local exchanges. That year, Galaxy's asset management AUM declined due to the broader crypto market environment (year-end 2022 AUM $1.7 billion, down 14% year-over-year), but the company strategically focused on "scaling active strategies": for example, the Galaxy Interactive fund successfully completed investments in multiple gaming/metaverse startups, and the Liquid Alpha hedge fund still achieved net subscriptions despite difficult market conditions.

- 2023: In February, Galaxy successfully auctioned and acquired the GK8 digital asset custody platform from bankrupt Celsius Network for approximately $44 million (far below Celsius's original acquisition price of $115 million). The GK8 team of nearly 40 people (including top crypto security experts) formally merged into Galaxy, establishing a new R&D center in Tel Aviv. GK8's patented technology includes offline cold storage transaction signing and MPC hot storage, allowing institutions to sign on-chain transactions in an offline environment and perform automated, multi-signature custody operations. This acquisition significantly enhanced Galaxy's capabilities in secure custody, staking, DeFi access, and other infrastructure areas, hailed by CEO Novogratz as "a key step towards providing a full financial platform." GK8 was subsequently integrated into the GalaxyOne platform, becoming a crucial tool for Galaxy to offer self-managed assets to institutional clients. 2023 also saw highlights in Galaxy's asset management business: on one hand, Galaxy was appointed as an advisor to the FTX bankruptcy estate team, assisting in the disposal of FTX's asset portfolio, bringing additional management fee income and reputation enhancement; on the other hand, with the market rebound, Galaxy's AUM bottomed out and recovered in the second half, reaching ~$3 billion by Q4. At the end of 2023, Galaxy announced the launch of its upgraded asset management platform brand "Galaxy Asset Management & Infrastructure Solutions," integrating traditional asset management with blockchain technical services, highlighting its differentiated positioning.

- 2024: This year, Galaxy's asset management and blockchain infrastructure businesses entered a rapid development channel. In July, Galaxy announced the acquisition of most assets of CryptoManufaktur (CMF), a blockchain node operator founded by veteran Ethereum engineer Thorsten Behrens. CMF specializes in automated Ethereum node deployment and oracle infrastructure operations. This move immediately added approximately $1 billion equivalent in Ethereum staking assets (boosting Galaxy's total staking scale to $3.3 billion). CMF's three-person core team joined Galaxy, accelerating the company's technical accumulation in Ethereum staking and Oracle data services. Staking became one of Galaxy's biggest highlights in 2024: benefiting from the Ethereum Shanghai upgrade enabling withdrawals and institutional entry, Galaxy's staked assets skyrocketed from only $240 million at the beginning of the year to $4.235 billion by year-end, a nearly 17-fold increase ($1 billion from M&A, the rest organic growth). The company顺应市场需求, successively partnered with multiple mainstream custodians: in February, Galaxy became BitGo's integrated staking service provider, allowing BitGo custody clients to one-click use Galaxy nodes for staking and use staked assets for third-party loans; in August, Galaxy partnered with Zodia Custody (an institutional custodian backed by Standard Chartered) to provide compliant staking solutions for European clients; additionally, it expanded technical integrations with Fireblocks, Anchorage Digital, etc. These measures greatly broadened the distribution channels for Galaxy's staking services.

- 2025: In 2025, with gradually明朗的市场和监管环境, Galaxy's Asset Management & Infrastructure segment continued to advance大步. In Q3 2025, Galaxy reported this segment achieved a single-quarter adjusted gross profit of $23.2 million, up 44% from Q2, reflecting business scale expansion. The primary growth driver was over $2 billion in net new inflows during the quarter, sourced from multi-year mandates from large digital asset holding institutions. These institutions (e.g., crypto project foundations, public company treasuries) entrusted assets to Galaxy for management and staking. Disclosed data shows they have cumulatively contributed over $4.5 billion in assets as of Q3, generating over $40 million in annual recurring management fee income. Galaxy terms this service "digital asset treasury outsourcing," helping project teams or enterprises manage their crypto asset reserves for steady增值. Consequently, Galaxy's AUM rose to nearly $9 billion, and staked assets reached $6.61 billion, both hitting record highs. On October 29, Galaxy announced the completion of staking business integration with Coinbase Prime, becoming one of Coinbase's select staking service providers. Through this partnership, Coinbase institutional clients can seamlessly access Galaxy's high-performance validator node network on their platform, marking Galaxy's staking business entry into top-tier custody ecosystems. Overall, in 2025, Galaxy achieved simultaneous progress in product innovation, scale growth, and ecosystem深耕 in the asset management and infrastructure segment.

Financial Reports & Public Report Summary (2023–2025)

Asset Management Business Performance: In 2023, Galaxy's asset management income declined amid market downturn, but as行情回暖 in Q4, management fee income began to recover. 2024 was a harvest year for the company's asset management business: full-year revenue reached $49 million, a record high (significant growth compared to ~$28 million in 2022). Drivers included: organic net inflows and market appreciation boosting AUM and asset-based fee income; and commissions from Galaxy's role as agent for executing FTX bankruptcy estate asset disposals, contributing substantial收益. By the end of 2024, Galaxy's AUM reached $5.66 billion, also up from ~$4.6 billion at the end of 2023. ETF/ETP products accounted for $3.482 billion, and alternative investment products (e.g., venture capital funds) accounted for $2.178 billion. The operating margin of the asset management business also improved in 2024, with full-year adjusted EBITDA exceeding $20 million, indicating scale effects gradually materializing.

In the first three quarters of 2025, Galaxy's asset management segment continued growing in a strong market environment. Especially in the just-passed third quarter:

- Galaxy's AUM reached nearly $9 billion, with alternative investment products surging 102% QoQ to $4.86 billion, and ETFs also growing to $3.8 billion;

- Staked asset scale also increased 110% QoQ to $6.6 billion.

- Driven by this, the Asset Management & Infrastructure Solutions segment's revenue (adjusted gross profit under GAAP) was $23.2 million, up 44% QoQ, with single-quarter revenue接近 half of the full-year 2024 level.

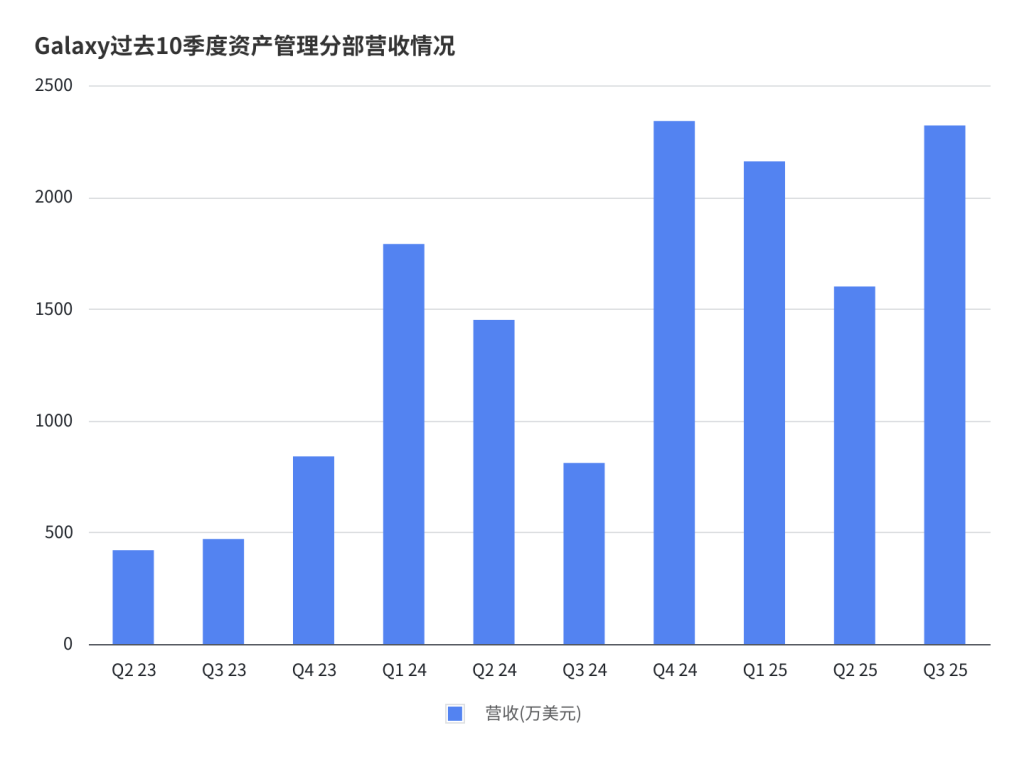

Galaxy 25Q3 Asset Management Business Adjusted Gross Profit, AUM (including ETFs and Alternative Products), and Staked Asset Scale

Overall, from 2023–2025, Galaxy's digital asset segment, including Global Markets and Asset Management, achieved a leap from低谷 to高峰,伴随着加密牛市、监管利好、ETF落地等利好因素, setting new records in both revenue and profit.

2.3 Data Centers & Computing Power Business

Business Content & Definition

The Data Centers & Computing Power business is Galaxy Digital's second major strategic area beyond digital assets, focusing on investing in, building, and operating foundational computing power infrastructure. Its core is converting abundant energy and data center resources into computing power usable for blockchain mining and high-performance computing (HPC), creating value for itself and clients. Galaxy initially entered this领域 via Bitcoin mining: deploying专业矿机, utilizing self-owned or hosted data center computing power to obtain Bitcoin block rewards. Simultaneously, the company provided hosting services and financial support to other miners (e.g., machine hosting maintenance, power purchase strategy consulting, miner financing, etc.), building a mining ecosystem chain. With the explosive growth in computing power demand from the AI and big data era, Galaxy began a strategic adjustment in 2023, gradually expanding data center resources for HPC tasks like AI model training and cloud rendering. Specifically, Galaxy partners with AI infrastructure companies to transform its large campuses into AI computing power supply bases, obtaining stable租金和服务收入 through leasing electricity and server rack space (essentially providing "computing power infrastructure as a service (IaaS)").

Currently, Galaxy's most核心的数据中心资产 is the Helios data center campus located in Dickens County, Texas, USA. The Helios campus was initially developed by Argo Blockchain, aiming to leverage cheap renewable energy (wind and solar) in West Texas for Bitcoin mining. However, at the end of 2022, soaring natural gas prices led to increased electricity costs, and Argo lacked effective fixed-price power purchase agreements, leaving it fully exposed to extreme electricity price volatility. Under liquidity crisis pressure, Argo sold the Helios facility to Galaxy Digital for $65 million in December 2022 (with an additional $35 million loan attached).

For Galaxy, this transaction included not only physical assets but also the crucial 800 MW grid interconnection approval capacity. Currently in Texas, large-load grid interconnection approval queue times have extended to over 4 years. Therefore, Helios's existing interconnection permit became one of the most valuable intangible assets on its balance sheet. In terms of scale alone, 800MW places Helios in the global第一梯队 of computing power campuses – for comparison, Google's new AI data center in Arizona plans for about 1,200MW, and Microsoft's expansion projects in Iowa等地 are in the 300-600MW range. Thus, Helios's scale is already considerable. If the 3.5GW long-term vision is achieved (an additional 2,700 MW interconnection permit is still under审批), it would be almost double the size of the world's largest current data center cluster.

In具体业务, Galaxy does not directly operate AI cloud services but has signed a 15-year long-term hosting agreement with CoreWeave. CoreWeave is a top-tier cloud service provider invested in by NVIDIA, with极度饥渴 demand for computing power infrastructure. The series of long-term lease agreements essentially convert Galaxy's power resources into bond-like stable cash flow. Currently, CoreWeave has exercised all available options, locking in Helios's entire currently approved 800 MW power capacity. The合作采用了 Triple-Net (NNN) lease structure: Galaxy is primarily responsible for providing the physical shell and power接入, while CoreWeave bears electricity costs (including price fluctuation risk), equipment maintenance, insurance, and taxes. Under this model, Galaxy更像数字地产商,而非运营服务商, resulting in相当高的现金流稳定性. For Galaxy, its收入几乎等同于净利润, with预计该业务的 EBITDA 利润率将高达 90%.

Galaxy divides Helios campus development into multiple phases: Phase I plans to deploy 133 MW in the first half of 2026, Phase II deploys 260 MW in 2027, Phase III deploys 133 MW in 2027, totaling 526 MW of "critical IT load" available for servers (corresponding to 800 MW total power capacity). To适应 CoreWeave's需求, Helios is accelerating改造 from "mining farm" to "HPC data center,"主要包括冷却系统升级、冗余架构以及结构加固等.

Key Development History

- 2018–2020: Driven by the digital asset bull market, Galaxy recognized the important value of upstream computing power and began涉足 Bitcoin mining领域. Initially, the company adopted a合作托管模式,委托矿机 to专业矿场运营, while providing配套金融服务 like miner financing and OTC hedging, accumulating experience and resources. During this period, Galaxy discreetly invested in some mining infrastructure projects and assembled a team精通电力和矿机技术, preparing for subsequent self-built mining facilities.

- 2021: Galaxy formally announced the establishment of the "Galaxy Mining" department, elevating mining to one of the company's core strategies. That year, Galaxy expanded合作 with multiple large North American mining farms and actively sought suitable locations in Texas等地 to build自有数据中心.

- 2022: This year was a milestone for Galaxy's data center business. On December 28, 2022, Galaxy announced the acquisition of the Helios Bitcoin mining facility in Dickens County, Texas, from Argo Blockchain for $65 million (including全套运营资产), and provided Argo with a $35 million loan to help it渡过流动性危机. The Helios facility was newly operational, possessing 180 MW of built power capacity with significant expansion space. After acquisition, Galaxy immediately took over operations, making it its core mining base. The company announced plans to increase Helios's operational power to 200 MW by the end of 2023, with部分容量用于托管第三方矿机,部分用于 Galaxy 自营挖矿. This acquisition极大提升了 Galaxy 矿业版图,被视为 "Galaxy拥有了自己的比特币采矿工厂".

- 2023: Galaxy's data center business began transitioning from "mining mode" to "mining + computing power leasing dual-track" this year. In the first half, Helios steadily expanded: by mid-2023, deployed hashrate was约 3 EH/s, with Galaxy's proprietary and hosted operations roughly equal. Bitcoin price recovery in the first half also restored mining operations to profitability. In Q2 2023, Galaxy disclosed in its earnings report that its mining department's Hashrate Under Management (HUM) reached约 3.5 EH/s, with proprietary BTC production unit costs保持业内较低水平. In the second half, while continuing to提升 Helios Bitcoin hashrate, the company proactively discussed合作意向 with CoreWeave, exploring the possibility of leasing部分电力和场地 to CoreWeave for deploying GPU servers. In September 2023, Galaxy reached a preliminary agreement with

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News